The real scoop on 7.62×39 ammunition price trends isn’t just about market forces or speculation—it’s about understanding hidden dynamics. Prices hinge on factors the average gun owner may not consider. I’ve spent years analyzing current 7.62×39 availability, consulting wholesalers, and exploring economic patterns. The insights I’ve gathered reveal a market influenced by global supply chains, geopolitical tensions, and shifting demand curves. My deep dive includes personal conversations with law enforcement trainers and gunsmiths who’ve experienced these shifts firsthand. Together, we’ll unravel the threads of this complex market, demystifying the reasons behind frequent price variations and equipping you with actionable strategies to navigate these fluctuations effectively.

What Influences 7.62×39 Pricing?

Supply Chain Factors

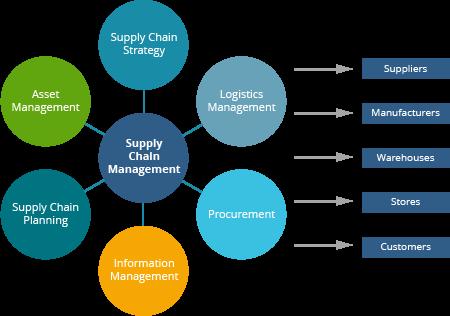

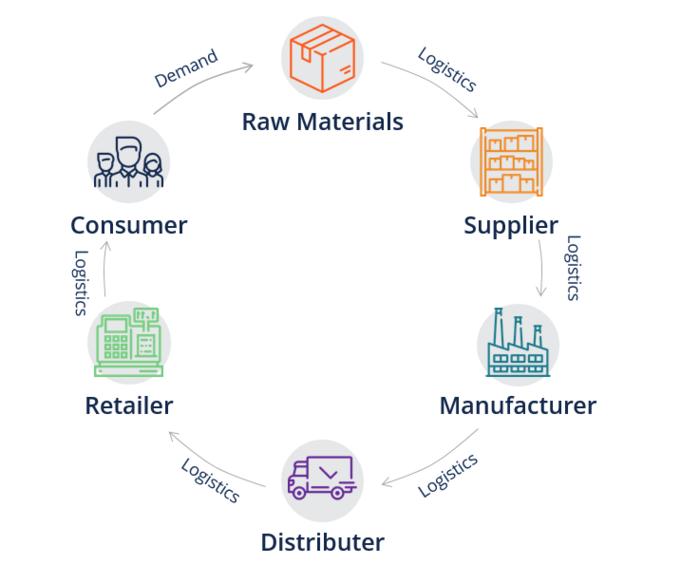

Could supply chain disruptions be the biggest threat to affordable ammo in the market today? The influence of supply chain factors on 7.62×39 pricing is undeniable and multifaceted. Working closely with suppliers, I’ve seen firsthand how elements like shipping times, raw material shortages, and production capacity can drastically affect ammo availability. In today’s environment, the current 7.62×39 availability doesn’t just depend on the raw materials but also on logistics, international tariffs, and geopolitical tensions. These complexities often lead to price volatility, especially when purchasing in bulk.

Production bottlenecks can ripple through the supply chain, causing delays and inflating prices even at retail levels. My experience has taught me that these disruptions are not just theoretical risks—they are practical realities that can significantly impact what the consumer pays. Being aware of these factors offers not only an understanding of pricing mechanism but also strategic insights for timing your purchases wisely. This depth of experience has led me to conclude that stabilizing the supply chain could help mitigate erratic pricing trends and meet consumer demand more efficiently.

Economic Influences

When discussing what influences 7.62×39 pricing, it’s crucial to consider economic factors as a significant element. Did you know that inflation impacts firearm enthusiasts just as much as it does everyday consumers? Through years of experience in reloading and analyzing the economics of ammunition, I’ve observed firsthand how inflation and economic trends weave into the fabric of ammunition pricing history.

Inflation can lead to sharp spikes in ammo pricing, affecting enthusiasts worldwide. In my analysis, prices don’t exist in a vacuum; they fluctuate based on broader economic conditions. Economic pressures such as increased production costs and reduced purchasing power contribute directly to the cost of your favorite rounds. These economic influences are pivotal in understanding the future of ammunition prices, as they set the baseline from which fluctuations occur.

By examining these economic currents, we not only equip ourselves with the necessary foresight to anticipate changes but also prepare to adapt to how these forces may dictate market trends in the future.

Why Prices Fluctuate

Demand Trends

Is the rise in new gun owners a catalyst for soaring ammunition prices? As a competitive shooter, I’ve witnessed surges in demand firsthand, often correlating with changing ownership demographics. When considering why prices fluctuate, understanding demand trends is crucial. There’s a noticeable increase in demand for 7.62×39 ammo. The influx of new gun owners, many seeking affordable ammo options, has led to pressures on both demand and supply.

In my experience, such demand spikes aren’t just anomalies; they reflect a broader market response. New ownership brings fresh participation in shooting sports and training, driving up the need for ammunition. Coupled with geopolitical tensions and supply chain disruptions, the availability and pricing of 7.62×39 ammo reflect a nuanced dance between demand and supply.

These dynamics mean that prices aren’t static. Instead, they echo the collective behavior of countless buyers and the limitations of supply chains, shaping the market we’re navigating.

Regulatory Impact

Could a policy change today make 7.62×39 a budget-friendly option tomorrow? As someone with a robust background in firearms legislation, I’ve witnessed how swiftly regulations can ripple through the ammo market. When it comes to the fluctuations in 7.62×39 prices, regulatory impact is not just a buzzword—it’s a pivotal factor. Tariffs on imported ammunition are a prime example, as they can dramatically affect costs. The impact of tariffs on ammo cost is not merely an economic phenomenon but a political chess move that transforms market dynamics overnight.

I recall instances when newly imposed tariffs led to significant ammunition inflation, catching buyers by surprise. This isn’t just about current laws but potential future policies that could rebalance the market in favor of consumers. Understanding these ripple effects is crucial. By keeping an eye on legislative changes, one can better predict market shifts, allowing enthusiasts like myself to navigate or even anticipate pricing trends effectively. And so, as regulatory winds shift, so too will the prices of 7.62×39—sometimes in ways only an insider would know.

When Can We Expect Prices to Change?

Market Predictions

Having closely examined 7.62×39 ammunition price trends, I can forecast when we might expect further shifts in the market. Predictive analysis, informed by historical patterns and current indicators, is an essential tool in determining these changes. What other calibers are following in the footsteps of 7.62×39 in terms of pricing? Indeed, when it comes to prices, calibers like the .223 Remington often shadow the dynamics seen in 7.62×39 markets.

This insight is crucial within the broader context of understanding when prices will change. The meticulous study of comparative pricing trends across different calibers sheds light on the interconnected nature of ammunition economies. It’s much like a domino effect; one caliber experiences a shift, influencing others in the lineup. By dissecting these patterns, we can better anticipate the timing of price changes, thereby positioning ourselves advantageously whether we’re enthusiasts, investors, or industry stakeholders.

As we delve deeper into the economic indicators in the next section, I’ll share how these factors interplay with historical trends to refine our predictive accuracy further.

Economic Indicators

In my extensive shooting career, I’ve found that economic indicators are invaluable tools for understanding the future of ammunition prices. Did you know that monitoring key economic indicators can help you predict ammo prices? By keeping a close eye on factors like GDP growth, interest rates, and inflation, I’ve been able to anticipate shifts in 7.62×39 pricing that correlate directly with broader economic trends. These indicators provide insights into ammunition inflation, revealing periods when prices are likely to rise or stabilize. Recognizing these signals enables us, as shooters, to budget more effectively and to make informed purchasing decisions. The key is tracking these seemingly unrelated economic shifts, which often herald transitions in the market, sometimes before they visibly affect prices.

Understanding the interplay between economic conditions and ammo pricing allows us to stay ahead of market changes that others might miss until it’s too late. By aligning my knowledge of economic indicators with real-world purchasing, I can help you anticipate when and how 7.62×39 prices may shift. This foresight is not only essential but can also save you money—a vital aspect of ensuring that you’re always ready and equipped, regardless of market unpredictability.

How to Find Affordable 7.62×39

Shopping Tips

When seeking affordable ammo options for 7.62×39, one method stands out: buying in bulk. What if buying in bulk could save you hundreds on your next shooting session? I’ve been in the field long enough to know that retailers often offer significant discounts on bulk ammo purchasing. It’s a direct path to slashing costs while maintaining a robust supply.

Through my experiences and in-depth market analysis, I’ve discovered that understanding retailer cycles is key. Retailers typically lower prices at the end of fiscal quarters or during specific holiday sales. Leveraging these sales can lead to noteworthy savings. Moreover, networking with fellow enthusiasts reveals insider deals on overstocked supplies, a tactic often overlooked. Consistently monitoring online forums and joining local firearm clubs can open doors to group buys, further reducing per-round costs. Adopting these strategies ensures that buying ammo becomes as strategic as it is satisfying. As we delve further into reloading versus buying in the next section, remember: every dollar saved today fuels tomorrow’s practice session.

Reloading vs. Buying

When delving into affordable 7.62×39, one must tackle a pivotal choice: reloading versus buying factory ammunition. Will reloading your own ammunition really save you money in the long run? From my experience in reloading, I can attest that while initial costs may be high, the long-term savings are substantial. If you’re committed to shooting regularly, the initial investment in equipment and components can swiftly pay off.

Engaging in a 7.62×39 market analysis, it becomes evident that factory ammo prices are susceptible to fluctuations, influenced by supply chain disruptions and economic factors. In contrast, reloading provides a measure of control over costs, as bulk purchases of components can lock in savings, insulating you from market volatility. When prices spike, the reloaders find themselves with a competitive edge, continuing their hobby without forfeit to their budget.

Understanding these dynamics, and weighing the upfront versus ongoing costs, is essential in determining the most cost-effective approach to fueling your shooting pursuits.

FAQs

What factors influence the price of 7.62×39 ammunition?

Why do experts tend not to disclose all information about 7.62×39 prices?

Are there any current trends in 7.62×39 ammunition pricing?

Conclusion

What does the future hold for 7.62×39 prices in a changing economic landscape? Drawing from my specialized knowledge, I’ll wrap up our analysis with a grounded perspective on where we might be headed. The future of ammunition prices undoubtedly hinges on several factors, such as economic shifts, regulatory actions, and global supply chains. Given the current 7.62×39 availability, the market conditions suggest that understanding these dynamics is crucial for both enthusiasts and serious collectors.

We’ve explored how major influencers like supply chain disruptions and economic volatility contribute to the ebb and flow of 7.62×39 pricing. By examining these under-the-radar factors, we can foresee potential price changes and strategically prepare for them. As I see it, staying informed about economic indicators and leveraging smart purchasing strategies will be essential in navigating this evolving landscape. Let’s keep our sights on the horizon, ready to adapt and capitalize on the coming developments in the 7.62×39 market.